Background

As the halalan season approaches, the political climate in our country becomes a constant topic of discussion. It's hard not to notice the shifting opinions and emotions, but we also need to think about how far we've strayed from the true meaning of democracy. Many people seem to define democracy simply as "whoever wins the election" or what the majority wants. However, democracy is about governance by the people for the benefit of all—not just for the majority.

Understanding this difference is vital. If we have a misguided view of what we should be voting for, we could face serious consequences again. This concern has led me to revisit an idea I've been considering for a while, which I will explore in this text. By looking at the volatility of politicians as if they were an investment portfolio, I aim to highlight the importance of making informed choices in the composition of government offices and protecting our democratic values.

In this exploration, I will discuss the idea of analyzing politicians as if they were assets in an investment portfolio. First, I will outline the structure and purpose of this analogy, focusing on what makes a politician "volatile" and how their behavior and public perception can shift unpredictably. Then, I will examine different strategies for "investing" in politicians, such as betting on highly volatile candidates for high-risk, high-reward outcomes, choosing more moderate politicians for stability, or diversifying support to manage uncertainty. Finally, I will summarize key insights and draw conclusions about how applying investment strategies can help us navigate the political landscape more effectively.

Setup

In this exploration, we will assign a quantitative value to the democratic potential of an elected official, where a positive value signifies progress toward democratic ideals, and a negative value indicates democratic backsliding. We’ll refer to this value as the democracy score, which aims to capture the essence of true democracy—where power is vested in the people. A score greater than 0 means the official empowers the people, while a negative score suggests they are centralizing power away from the public.

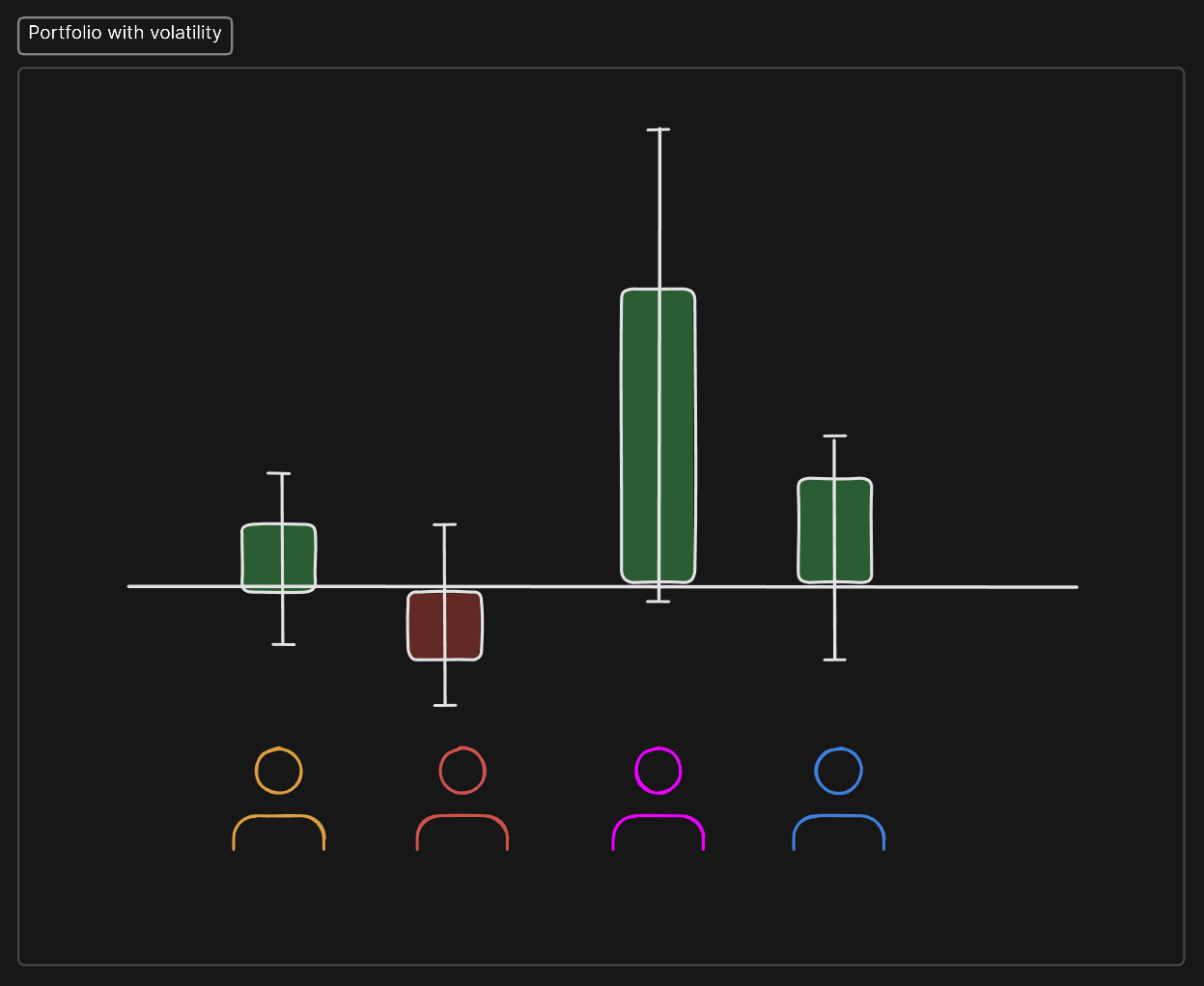

With this framework, we can estimate the average democracy score of officials currently in office and observe how our country’s democracy evolves over time. However, from a voter’s perspective, there is uncertainty about how any given official will influence democracy. While past reputation and platform consistency can reduce this uncertainty, no one can predict the exact impact. This uncertainty—the range of possible outcomes for each politician—is what we refer to as politician volatility.

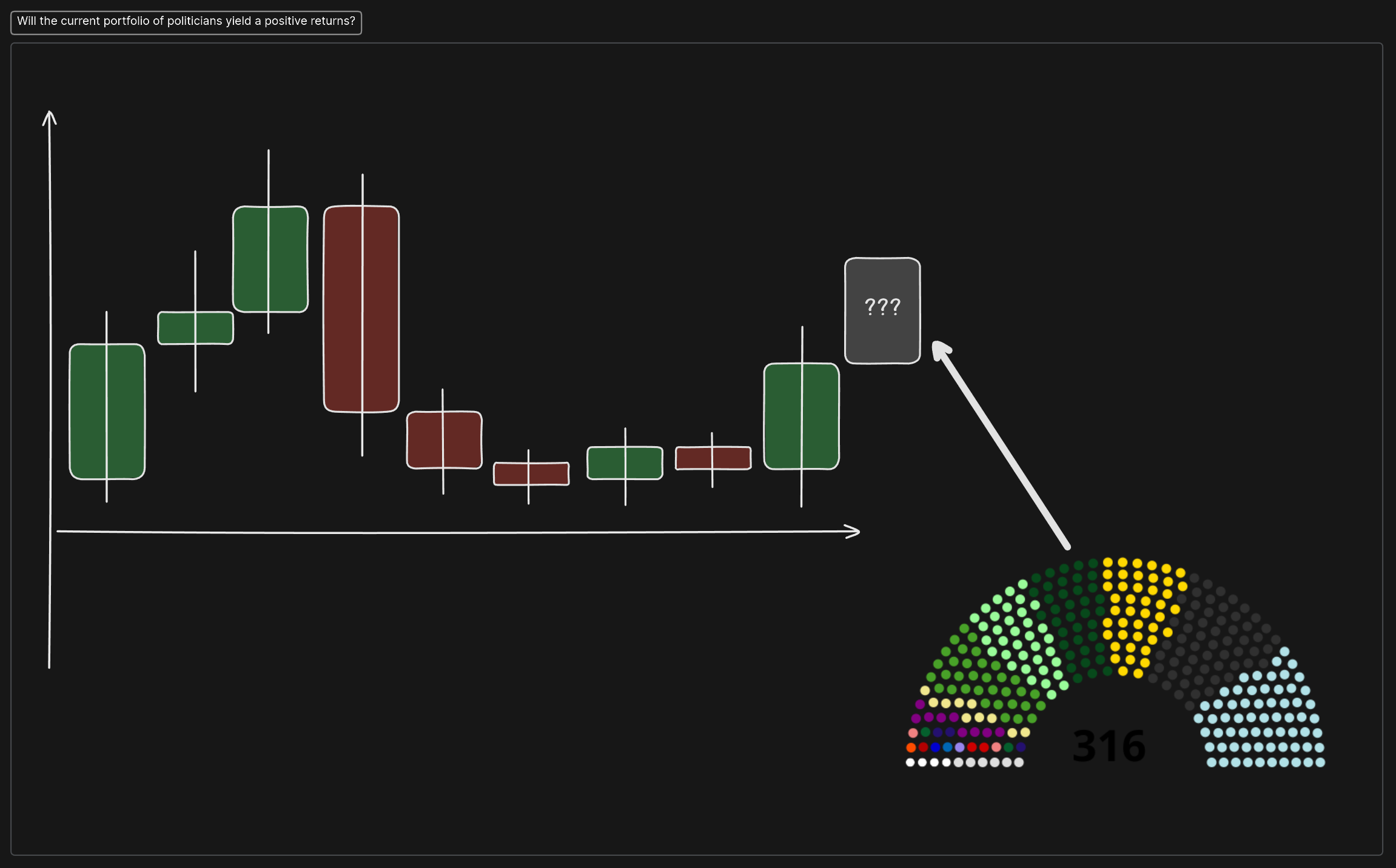

Reframing the voting process as analogous to building an investment portfolio, we can think of each vote as purchasing "politician stocks" with varying levels of volatility. The people "win" when the collective democracy score of their portfolio increases after an election, but if the score declines, it represents a bad investment round. The challenge for voters is to identify a strategy that, when repeated across many elections, consistently yields positive returns for democracy.

Analogy

To further illustrate the concept of volatility in politicians, let’s examine the two extremes:

A volatile politician is characterized by unpredictability, sudden emotional outbursts, and frequent changes in stance or behavior. These leaders are often highly reactionary, making decisions quickly and sometimes without a fully measured response. Their behavior can shift dramatically, from calm to confrontational or from one policy position to another. Depending on the context, this volatility can be either a powerful asset or a significant liability.

Pros:

- Quick decision-making in urgent situations

- Charisma and energy that inspire followers

- Willingness to challenge the status quo

- Adaptability in rapidly changing circumstances

Cons:

- Instability, leading to governance uncertainty

- Poor long-term planning and consistency

- Increased risk of conflict or erratic governance

- Erosion of public trust due to unpredictability

On the other hand, non-volatile politicians are defined by their stability, consistency, and a deliberate, measured approach to leadership. They tend to remain calm and predictable, favoring steady governance and long-term planning over emotional or impulsive reactions. While this style may seem less dynamic, it provides a sharp contrast to the volatility of reactionary leaders.

Pros:

- Stability and predictability, fostering a sense of security

- Thoughtful, well-considered decision-making

- Strong focus on diplomacy and collaboration

- Ability to build and maintain public trust

- A clear long-term vision for governance

Cons:

- Perceived lack of dynamism or excitement

- Slow response in times of crisis or rapid change

- Resistance to innovation or necessary reforms

- Difficulty in appealing to voters' emotional impulses

With these contrasting leadership styles in mind, we can now explore voting strategies that take into account the varying levels of volatility in political candidates, aiming to optimize our "political portfolio" for the best democratic outcome.

Investment strategies

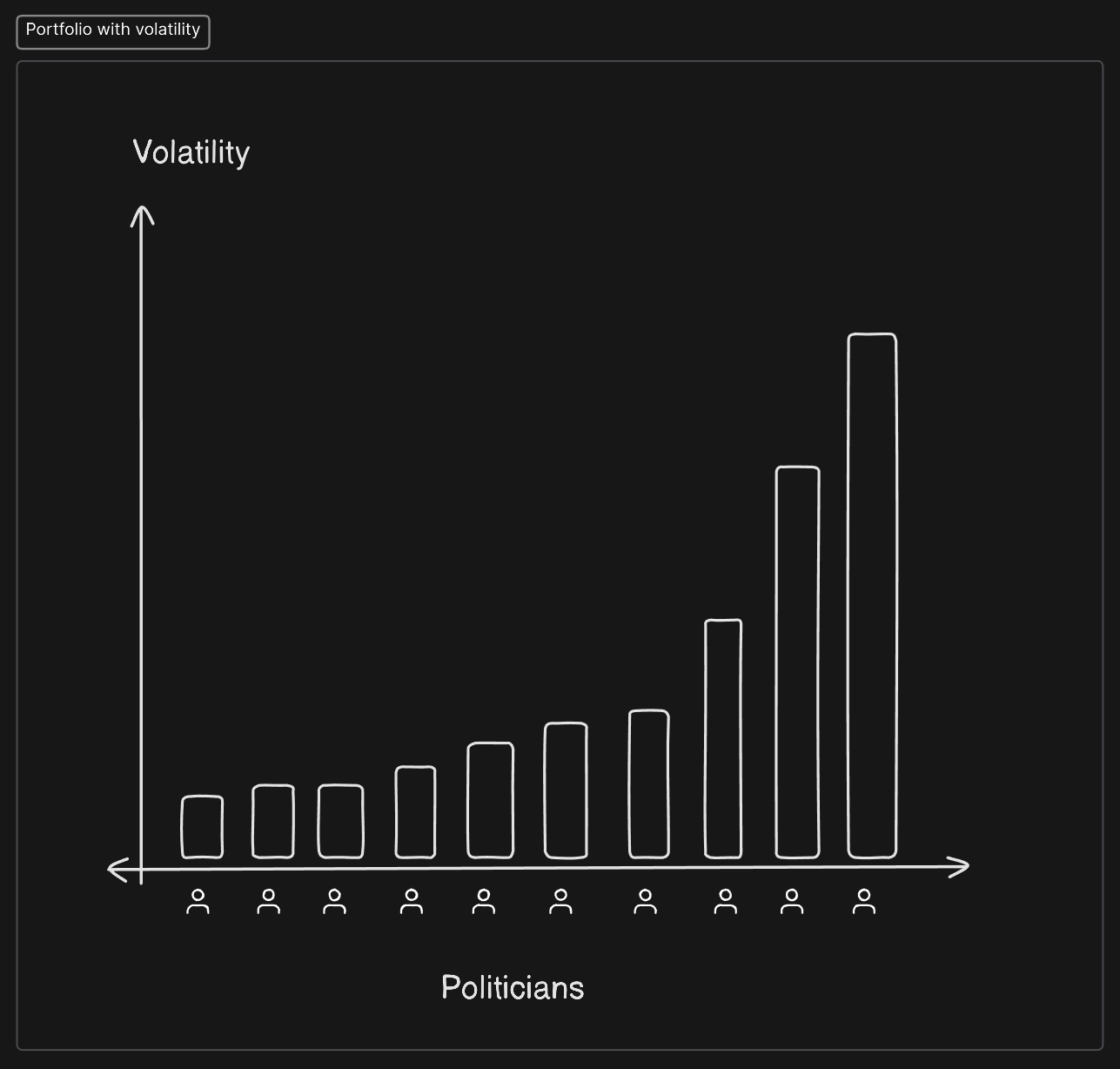

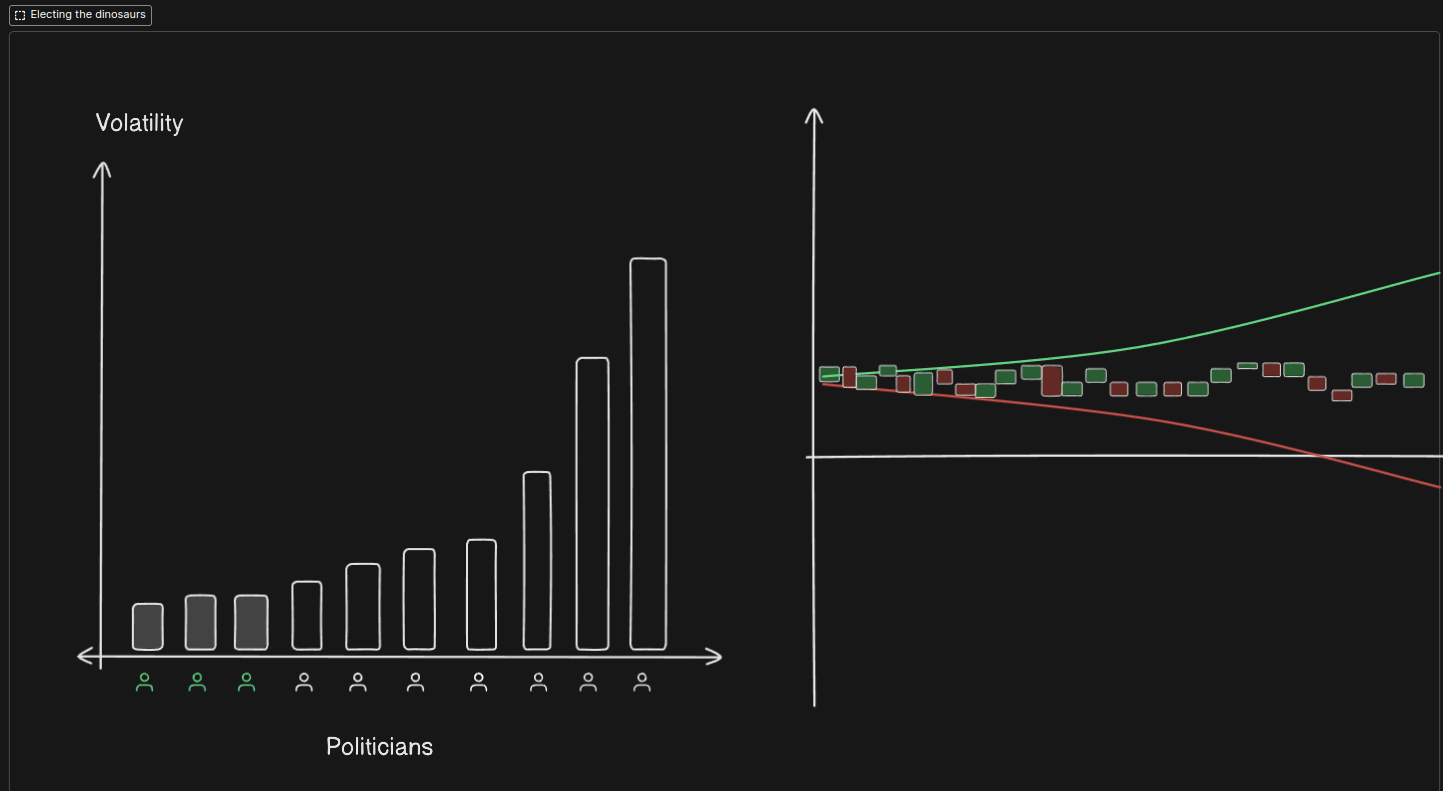

Let’s now assume that the power law applies to the distribution of a politician’s volatility. This means that a small number of highly volatile politicians will have a disproportionately large influence compared to their more stable counterparts, which mirrors how political hierarchies tend to amplify the power of those at the top.

With that established, let’s explore different voting strategies based on the volatility of political candidates:

Strategy 1: Placing All Eggs in One Extreme Basket

Let’s explore what happens when the Filipino people elect politicians solely based on their volatility, choosing one extreme or the other.

Case 1: Electing the Most Volatile Politicians

- Worst Outcome: Quick descent into tyranny and civil unrest.

- Best Outcome: Rapid reforms, bold innovation, and sweeping changes.

In this scenario, we elect politicians characterized by extreme unpredictability—our "crazy politicians." If we’re lucky and achieve the best-case scenario, the country experiences a brief golden age of democracy, where bold reforms and radical improvements take place. However, this success is short-lived. In the next election, the same volatile dynamics could just as easily plunge the nation into chaos or tyranny. Worse, if we get the worst-case outcome, we may end up under tyrannical rule. Once tyrants seize power, they can suppress opposition, making it nearly impossible to reclaim democratic freedoms. In essence, the people become “democratically bankrupt,” unable to invest in their future because they’ve lost their voice.

In this scenario, while the reward of rapid progress is appealing, the risk of long-term tyranny outweighs it. The potential for a brief golden era is not worth the heavy cost of a prolonged dictatorship. Bad investment.

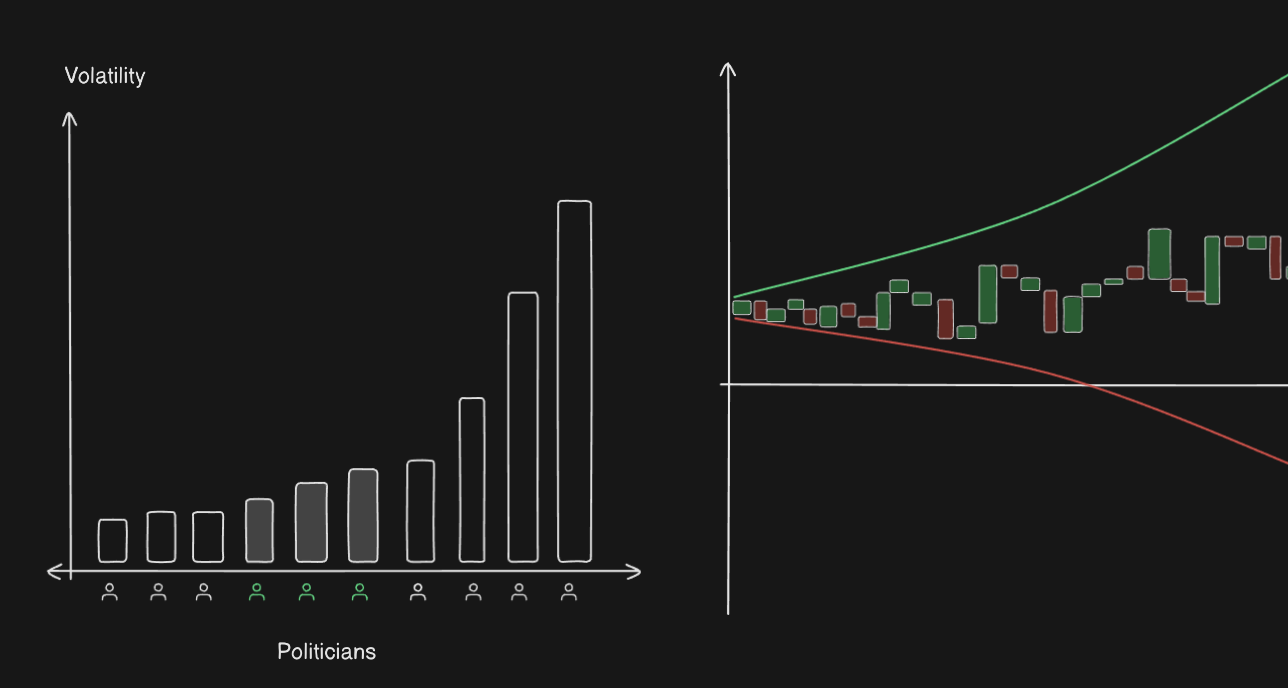

Case 2: Electing the Most Stable Politicians

- Best Outcome: Slow or nonexistent reforms, steady governance.

- Worst Outcome: Slow or nonexistent democratic decline, but extreme vulnerability to crises.

In this scenario, we fear instability, so we choose the most stable and predictable politicians. At first glance, this seems like a wise move—there’s little risk of tyranny, and the country avoids the chaos that volatility can bring. However, the cost of this stability is stagnation. Traditional values remain untouched, outdated anachronistic policies linger, and societal progress grinds to a halt. The expanding moral and democratic ideals are left to wither —our "dinosaur politicians."

While these stable politicians offer protection against democratic decline, they’re also highly vulnerable to unforeseen crises. In a country like the Philippines, prone to typhoons, earthquakes, and other unpredictable events, slow and cautious decision-making can’t keep pace with the challenges of the real world. These stable leaders may steer the ship safely for a while, but when a crisis hits—whether natural or political—their inability to adapt quickly can be disastrous. It’s reminiscent of dinosaurs, which thrived for millions of years in stability until an unexpected meteor struck, leading to their sudden extinction.

This strategy leaves the country in a prolonged state of limbo, only to be blindsided by a catastrophic event. Fragile investment. Bad investment.

In both cases, whether we elect the most volatile or the most stable politicians, the risk of long-term failure far outweighs the short-term gains. Neither extreme is a good bet.

Strategy 2: Bet on the Middle-Ground

Since placing all bets on the extremes leads to bad investments, why not aim for the middle ground?

In this scenario, we avoid electing the most volatile and the most stable candidates. Instead, we end up with a portfolio of politicians with moderate volatility. What we can expect from such a government is a mix of occasional progress and mild backsliding. It won't be extreme enough to result in tyranny, and while reforms will be made, they won't be groundbreaking. The government might face crises now and then, but it's resilient enough to manage or adapt to them.

Sounds ideal, right? Well, not quite. A government made up of moderate volatility politicians might be stable, but it also feels like a quiet-quitting version of governance. Leaders do just enough to avoid being ousted and secure votes for the next election but lack creativity or ambition. They maintain the status quo, focusing on self-preservation rather than pushing for higher democratic aspirations or meaningful change —our "mediocre politicians."

This is the government that does the bare minimum: no bold moves, no extra effort. The politicians enjoy their positions, funded by taxpayers, while barely moving the needle on progress. If an extended period of moderate democratic backsliding occurs, it could push the country to a point of no return—where the government can't course correct, and democracy slowly erodes into something less free.

If we’re incredibly lucky, we might get steady democratic progress, but more often than not, we’ll end up where we started. We’re left relying on fate, hoping things will improve without really doing much to change the odds.

If you ask me, I'd take a mediocre government over a chaotic or stagnant one. But it’s still disheartening to settle for a system that essentially admits defeat, accepting mediocrity as the standard.

In this investment, the upside is just as likely as the downside, with an expected net gain of zero—basically the same as not voting at all. In this scenario, you can't really fault non-voters for sitting it out because this type of government makes little to no significant impact. If you want to take a chance, you invest. If you don’t, nothing major will change.

It’s a bleak outlook, but is there a better option?

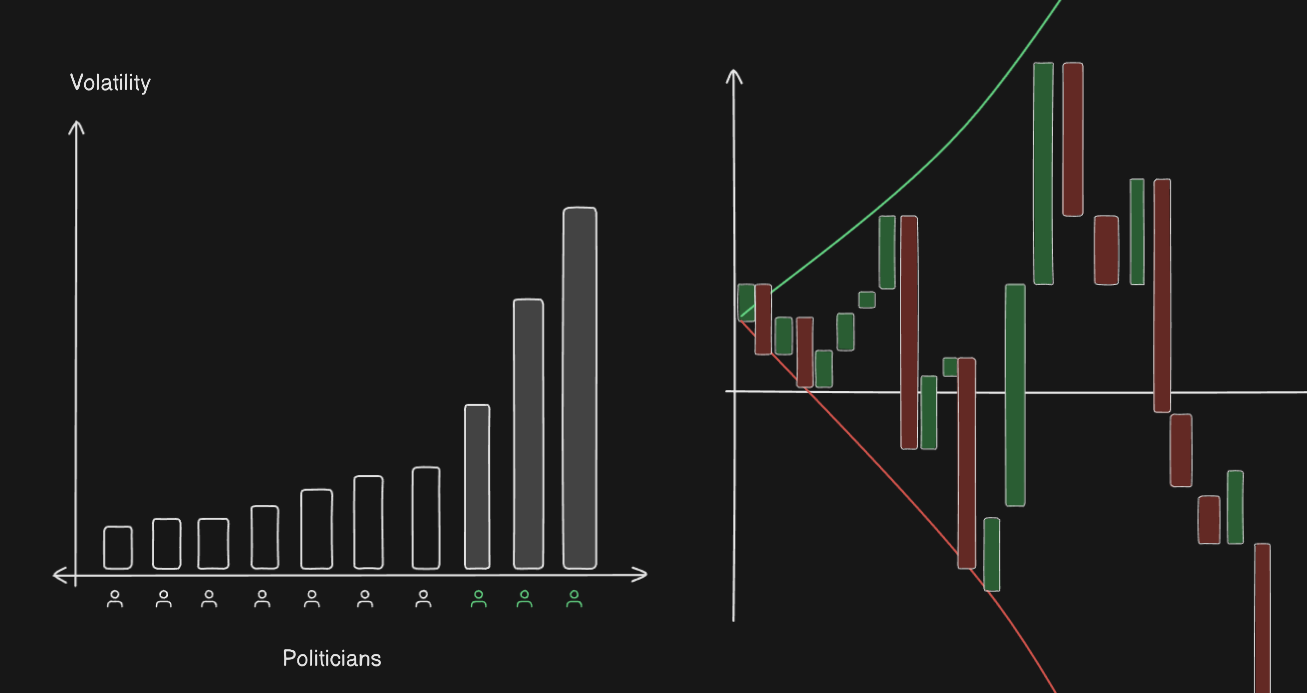

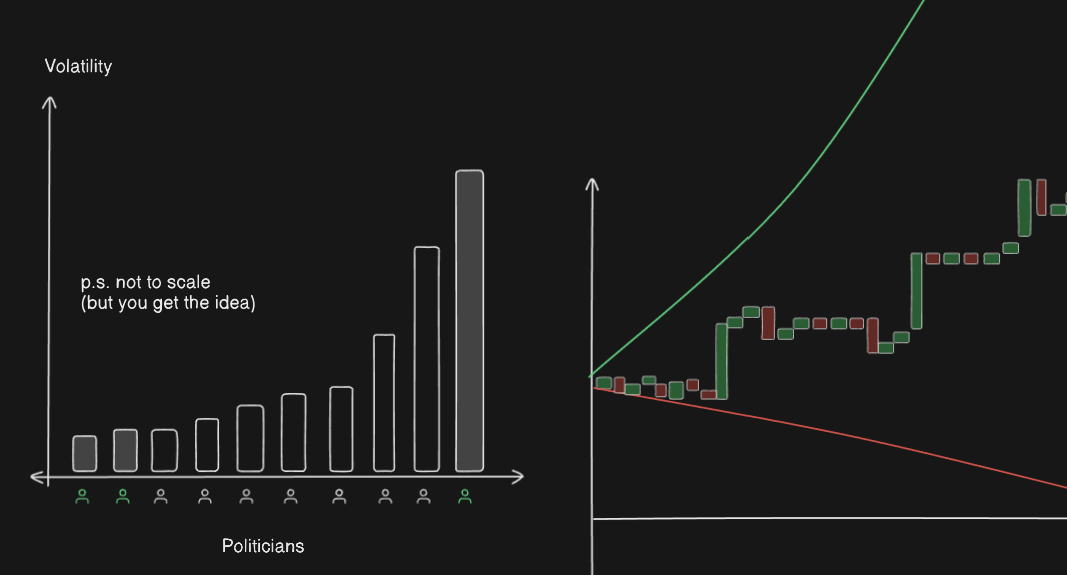

3. Convex Investment Strategy

For those familiar with investing, you may have already anticipated this approach. For those who aren’t, here’s the basic idea: in a convex strategy, you structure your portfolio to benefit from volatility. In simple terms, you limit your downside while leaving the upside open-ended. In our analogy, we want to minimize democratic backsliding while allowing democratic innovation to flourish without bounds. But how do we achieve this?

Imagine a government where 90% of the officials are stable (dinosaurs) and 10% are volatile (crazy politicians).

The 90% stable dinosaurs ensure steady, though slow, democratic progress. Their governance is stable and predictable, which provides a solid foundation for the country.

Meanwhile, the 10% volatile crazy politicians introduce dynamic, unpredictable elements. They may cause sharp increases or drops in democratic governance. However, if their policies fail or they cause disruptions, the damage is limited because the majority of the government is stable, keeping the system in check.

The real advantage of this strategy comes when the volatile politicians make disproportionately positive contributions. When these "crazy" officials innovate successfully, it can lead to significant leaps in democratic progress. Disruptive innovations that distribute more power to the people are quickly adopted, even by the risk-averse dinosaurs, once they see the tangible benefits.

This also sets a new baseline for mediocre politicians, forcing them to aim a little higher in future elections, raising the democratic standards overall.

You may wonder if we should include moderate politicians in this strategy. The answer is, they don’t add much value. Moderates neither introduce groundbreaking ideas nor provide the stability to counteract failed experiments. In essence, voting for moderates would be wasting a seat—and taxpayer money—on an inconsequential figure.

With this strategy, you can expect:

- Limited backsliding due to the stabilizing influence of the majority

- A steady, slow progression of democratic ideals

- Occasional unbounded spikes of innovation from the minority

By balancing stability with controlled bursts of volatility, you create a system where the downsides are contained, and the upsides are open-ended. Occasional bumps—both positive and negative—may occur, but the overall trend is upward, ensuring long-term democratic growth.

Conclusion

In this exploration, I have discussed the idea of analyzing politicians as if they were assets in an investment portfolio. This analogy highlights the unpredictability of political behavior and public perception, allowing us to better understand the volatility of different candidates. First, I outlined the structure and purpose of this analogy, focusing on what makes a politician "volatile" and how their actions can impact governance in ways that are often unexpected.

Then, I examined various strategies for "investing" in politicians:

- High Volatility (Crazy Politicians): Electing the most volatile politicians can lead to rapid reforms and innovation, but it comes with the severe risk of quickly descending into tyranny and civil unrest. The potential for a brief golden era of democracy is overshadowed by the likelihood of chaos and oppression.

- Low Volatility (Dinosaurs): Choosing the most stable politicians might offer a sense of security and predictability, but it often results in stagnation and resistance to change. While these leaders can maintain order, their inability to adapt to crises can leave the country vulnerable to unforeseen events, like natural disasters, resulting in disastrous outcomes when they occur.

- Moderate Volatility (Mediocre Politicians): Voting for politicians with moderate volatility leads to a government that is often characterized by a lack of ambition and creativity. While this approach avoids extremes, it leaves the electorate in a state of limbo, with little real progress or meaningful change. The risk of gradual democratic backsliding can become significant, and voters may find themselves hoping for luck rather than actively working toward improvement.

- Convex Strategy: The optimal strategy involves a convex model that elects a mix of stable politicians to provide a safety net while allowing a minority of higher-volatility leaders to pursue innovative democratic ideas.

This convex model not only limits potential backsliding but also facilitates a dynamic environment where positive change can flourish. By balancing stability with the possibility for disruption, we can foster an upward trend toward more robust democratic ideals, ensuring that progress is not just a fleeting moment but a sustainable trajectory for the future.

Caveats

This exploration provides a framework for understanding political dynamics through an investment lens, but it comes with notable caveats.

First, the models lack mathematical rigor, particularly regarding the ideal ratio of "dinosaurs" to "crazy" politicians in the convex strategy. More formal analysis could establish optimal proportions based on expected value, the number of government seats, and empirical data. Additionally, the framework assumes that all politicians lie along a spectrum with equal tendencies toward being progressive or repressive, with volatility as the only differentiating factor. In reality, most politicians lean toward a certain degree of progressive or repressive democratic ideals. Also, I didn't include politicians with repressive tendencies, as ideally voters should not invest in candidates who consistently display repressive behavior, much like one wouldn’t invest in a losing asset - but we know that reality is different.

While I didn't delve into the complexities of varying democratic tendencies in this analysis, this aspect could enhance the depth of understanding regarding the interplay between volatility and underlying political ideologies. If time permits, I may explore this angle in a future project. If you're interested for a second write up, please let me know.

Member discussion: